interest tax shield explained

Interest expenses are considered to be tax-deductible so tax shields are ve. The interest tax shield relates to interest payments exclusively rather than interest income.

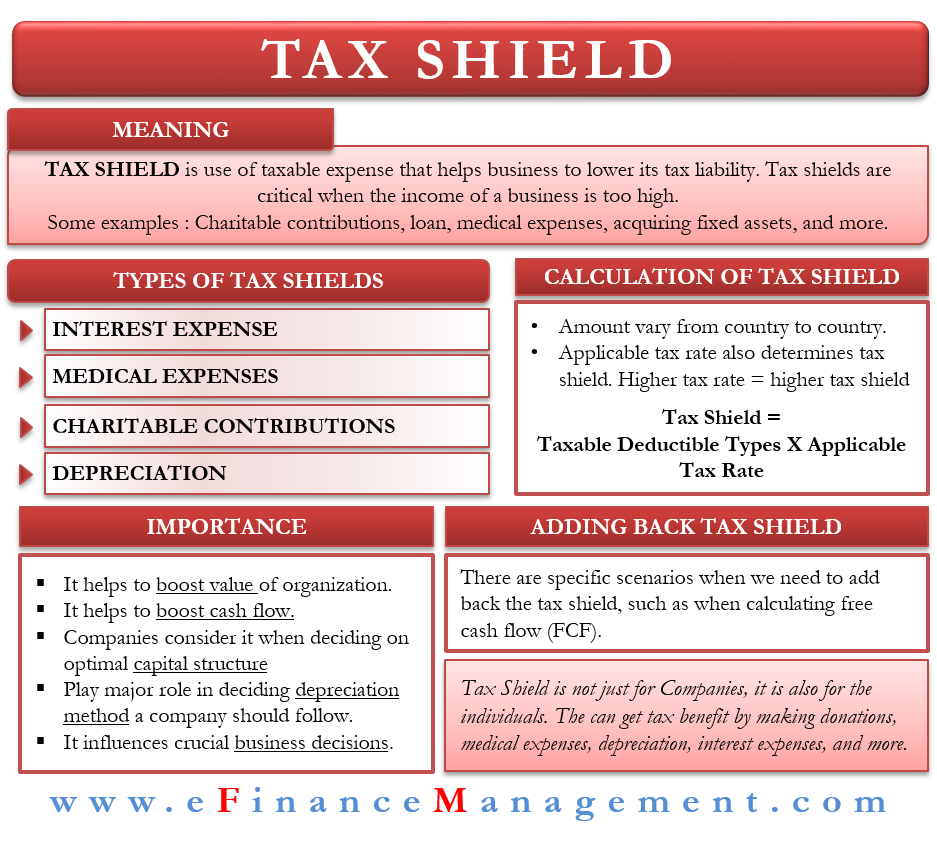

Tax Shield Meaning Importance Calculation And More

Tax-adjusted discount rates with investor taxes and risky debt.

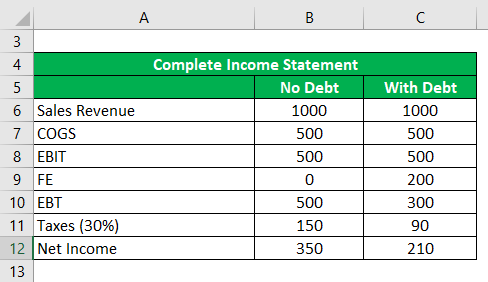

. Case 1 Taxable Income with Depreciation Expense The tax rate considered in the example is 40. Moreover this must be noted that interest tax shield value is the present value of all. Capital structure refers to the mix of equity funding and debt.

Tax Shield Value of Tax-Deductible Expense x Tax Rate So for instance if you have 1000 in mortgage interest and your tax rate is 24 percent your tax shield will be 240. Shields taxes paid is a Tax Shield. This reduces the tax it needs to pay by 280000.

Any expense that lowers ie. Tax Shield Strategies Capital Structure Optimization. The Depreciation Tax Shield reflects the Tax Savings from the Depreciation Expense deduction.

A tax shield is the deliberate use of taxable expenses to offset taxable income. This is equivalent to the 800000 interest expense multiplied by 35. Tax Shield for Individuals.

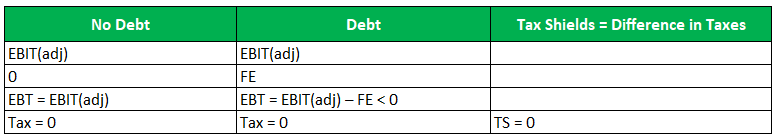

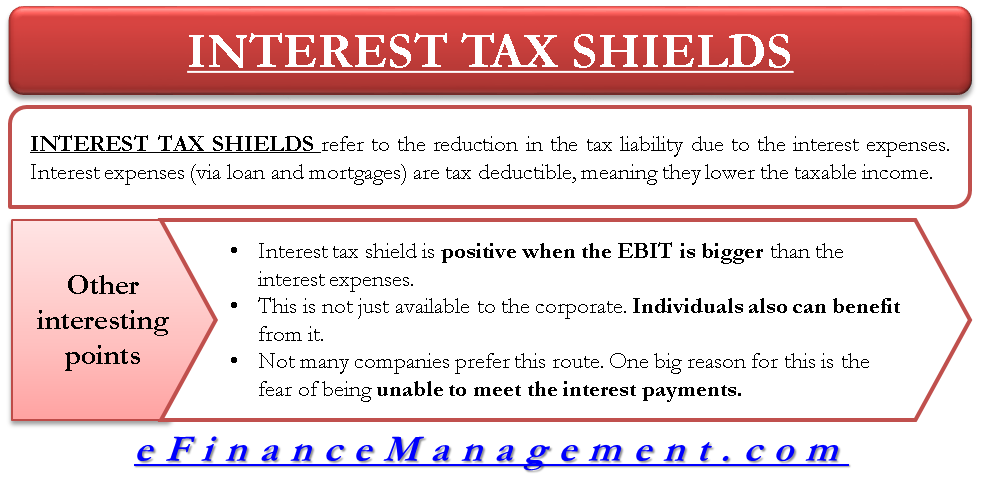

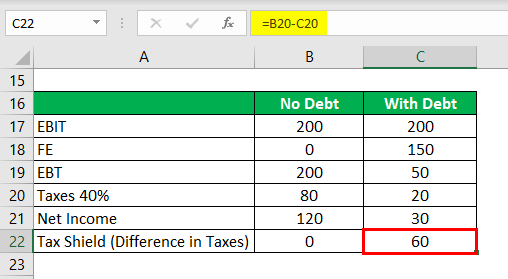

The interest tax shield is positive when the EBIT is greater than the payment of interest. Corporates pay taxes on the income they generate. The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below.

Interest Tax Shield Interest Expense Deduction x. A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income. In this video on Tax Shield we are going to learn what is tax shield.

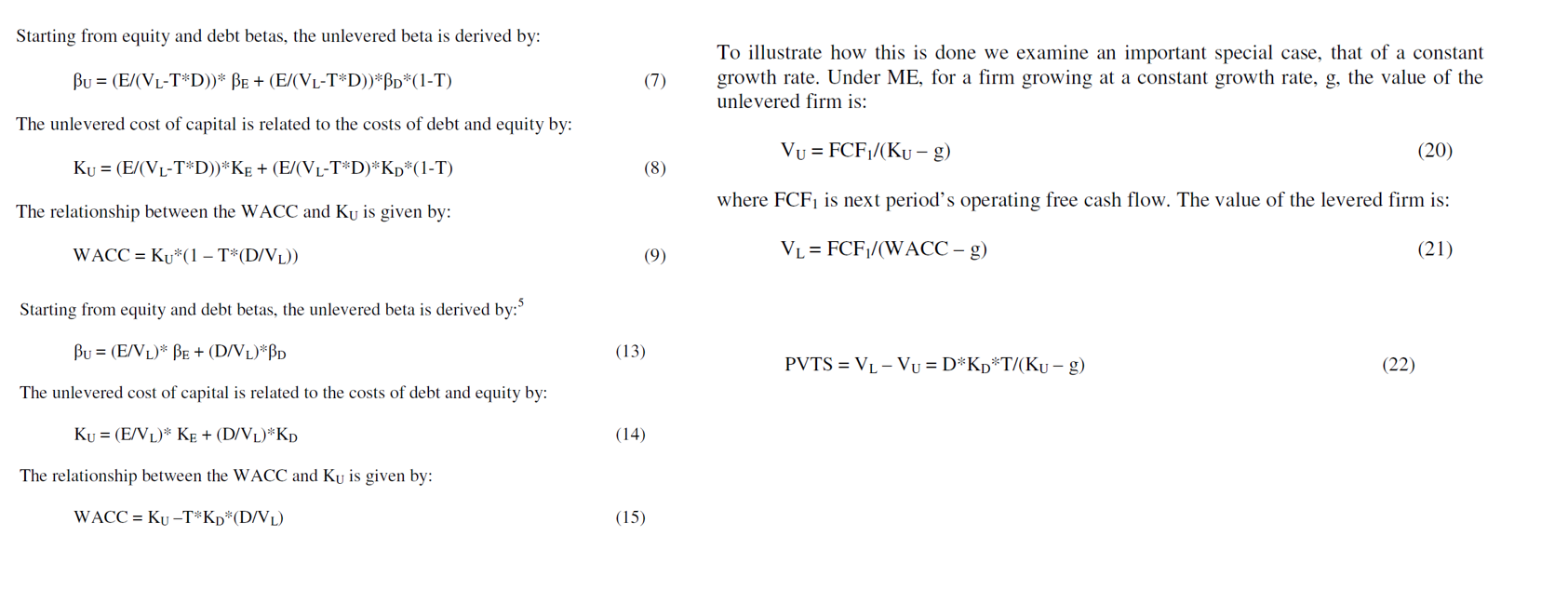

In the valuation of the interest tax shield it capitalizes the value of the firm and it also limits the tax benefits of the debt. The valuation of the interest tax shield capitalizes the total value of the firm. Interest tax shields refer to the reduction in the tax liability due to the interest expenses.

A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedClick here to learn more about this topic. They can limit the benefits of the company. The tax savings for the company is the amount.

TAX to be Paid over Income Revenues- Operating Expenses-Depreciation-Interest. Interest that a company pays on a loan or debt it carries on its balance sheet is tax-deductible. We also call this Interest tax shield.

What is Interest Tax Shield. Given that the interest. The intent of a tax shield is to defer or eliminate a tax liability.

By using an interest tax shield a company can. For example because interest on debt is a tax-deductible expense taking on. An interest tax shield is a term used to describe a tax break that involves deducting the interest paid on some portion of the income that is subject to taxation.

As such the shield is 8000000 x 10 x 35 280000. Interest payments on loans are deductible meaning that they. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible.

The deductible interest paid on debt obligations reduces a companys taxable income. Because the interest tax shields are included in the cash flows the CCF approach is easier to apply whenever debt is forecasted. The interest tax shields are another way for a business to reduce the risk of debt.

This can lower the effective tax rate. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest Deduction As Mortgage Interest Mortgage. Companies pay taxes on the income they generate.

If the expectations theory of interest rates holds firms pay the same present value of interest in the long run regardless of debt maturity. Valuation of the Interest Tax Shield. A tax shield refers to deductions taxpayers can take to lower their taxable income.

Examples of tax shields include deductions for charitable contributions mortgage deductions. Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒. The interest tax shield explained on one page.

Interest payments are deductible expenses for most companies. Interest expenses via loans and. This in turn reduces the total amount of tax payable by the firm.

However issuing long-term debt accelerates interest.

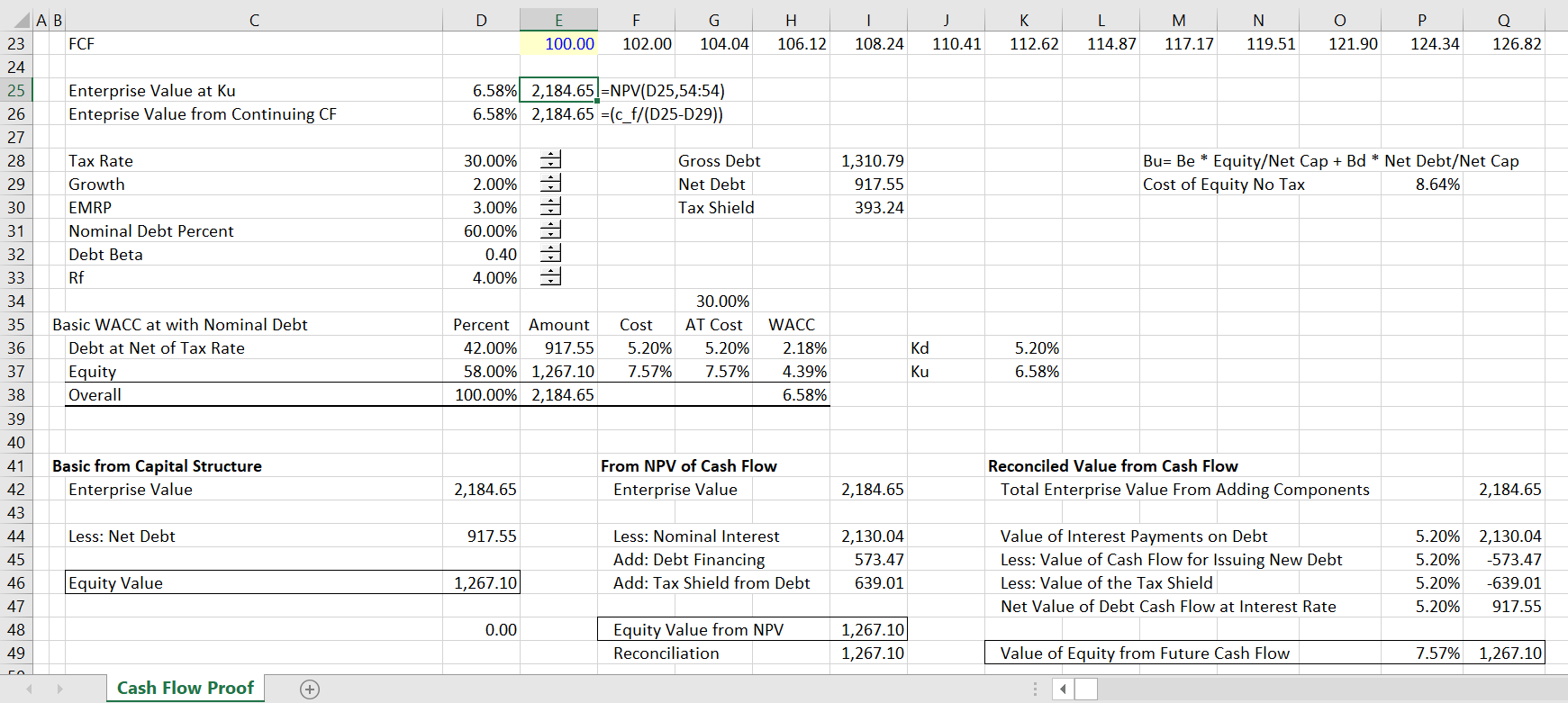

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula Step By Step Calculation With Examples

The Interest Tax Shield Explained On One Page Marco Houweling

Tax Shields Financial Expenses And Losses Carried Forward

Tax Shield Formula How To Calculate Tax Shield With Example

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Interest Tax Shields Meaning Importance And More

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

What Is A Tax Shield Depreciation Tax Shield Youtube

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Excel Calculator

Tax Shield Formula Step By Step Calculation With Examples