how to take an owner's draw in quickbooks

Ad Enhance Your QuickBooks Skills With Expert-Led Online Video Courses - Start Now. Master Invoicing Payroll Inventory Taxes More - Start Today.

Learn How To Record An Owner S Draw In Intuit Quickbooks Desktop Pro 2022 A Training Tutorial Youtube

For tax purposes it often helps to know how much the owner has taken in draws for the current.

. Learn about Recording an Owners Draw in Intuit QuickBooks Online with the complete ad-free training course here. Visit the Lists option from the main menu. Create a Prior year draws account at the beginning of the next year.

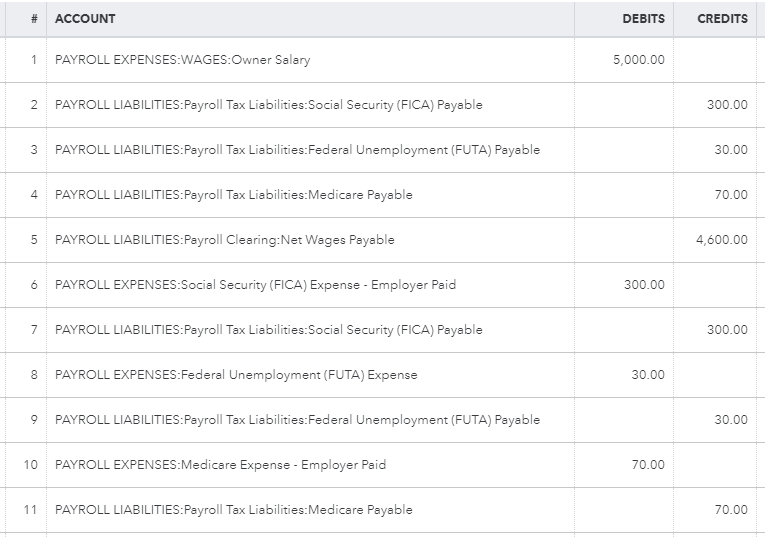

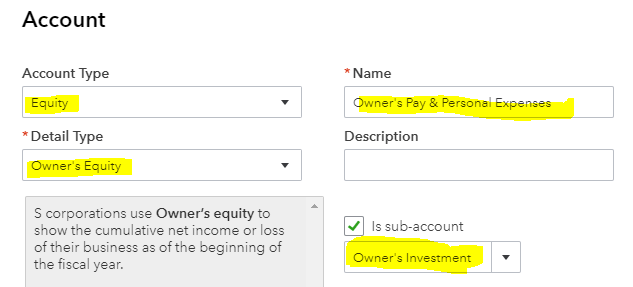

Before you can record an owners draw youll first need to set one up in your Quickbooks account. A members draw similarly called an owners draw or partners draw records the amount taken out of a company by one of. Setting Up an Owners Draw.

Setting Up Your Quickbooks Online Company Part Six Insightfulaccountant Com

How To Record An Owner S Draw The Yarnybookkeeper

How To Record Owner Draws Into Quickbooks

How To Record Owner Investment In Quickbooks Updated Steps

How To Record An Owner S Draw In Quickbooks My Vao

Anatomy Of Expert Quickbooks Online Setup Lend A Hand Accounting Llc

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc

Anatomy Of Expert Quickbooks Online Setup Lend A Hand Accounting Llc

How To Record Owner Withdrawal Into Quickbooks

How To Record Owner Draws Into Quickbooks

How To Clean Up Personal Expenses In Quickbooks Online

How To Record Owner S Equity Draws In Quickbooks Online Youtube

Minutesmatter Paying And Reimbursing Yourself In Quickbooks Minutesmatter

How To Set Up A Chart Of Accounts In Quickbooks Qbalance Com

Quickbooks And Owner Drawing Youtube

How Do You Pay Yourself As The Owner Of The Business Bookkeeping Network